- Credit combine-types of borrowing offered

- Regularity off apps for brand new borrowing

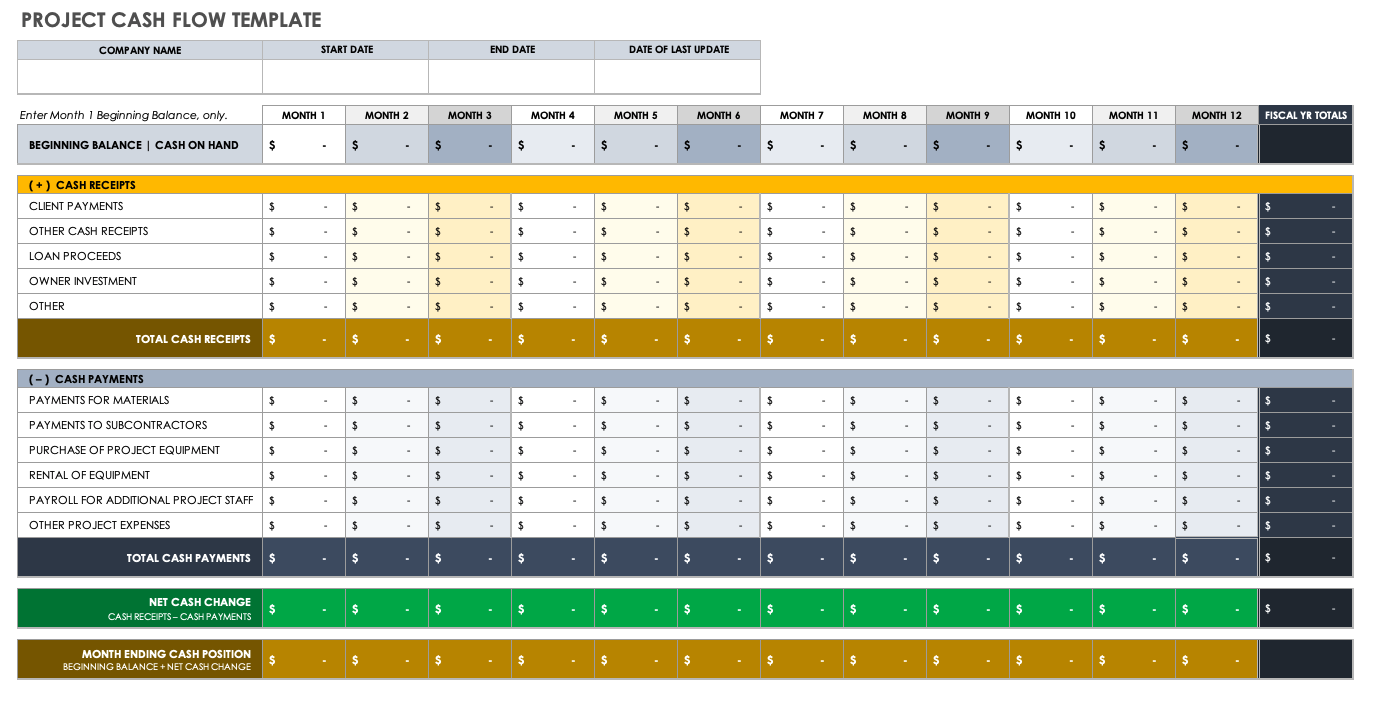

Even in the event a few of these activities are part of credit score calculations, they may not be considering equal weighting. Brand new dining table lower than alludes to brand new article on these activities of the advantages. You’ll see you to, within a good 35% weighting, initial factor with the credit rating is always to inform you a reputation expenses your debts punctually.

Furthermore, keeping a low application proportion by the not staying huge balance towards the your own credit cards or any other personal lines of credit (LOCs), having an extended credit rating, and you can refraining out-of always making an application for most borrowing also will let your ranking. Below are the top four key factors included in choosing borrowing evaluations.

FICO Score

FICO means getting Fair Isaac Corp., and that developed the analytical software regularly determine credit ratings. Loan providers use borrowers’ Fico scores along with other details in their credit file to assess credit chance and determine whether or not to increase borrowing from the bank. Credit ratings cover anything from 300 (very high exposure) so you can 850 (extremely reasonable risk).

With a top rating develops your chances of bringing accepted to have that loan helping with the criteria of your own give, for instance the interest rate. Having a low FICO Score are going to be a deal breaker to possess many lenders.

Due to the fact envisioned regarding the graph less than, last year, the common FICO Score in the us attained a low of 689. During the 2018, an average You.S. FICO Score hit a different sort of most of 701, appearing a steady up development in the You.S. credit quality. An average FICO Score regarding the You.S. flower again and you will attained 715 during the 2023, new tenth 12 months consecutively an average credit rating has not declined.

VantageScore Score

The newest VantageScore system, designed in 2006, is actually weighted differently off FICO. Inside strategy, lenders check out the average away from a customer’s available borrowing from the bank, latest borrowing from the bank, percentage history, borrowing from the bank use, breadth out-of credit, and you may credit balance. The most significant pounds is provided to help you commission history, breadth away from borrowing from the bank, and you may borrowing utilization.

The newest VantageScore range range away from 3 hundred in order to 850. Those with a score away from 3 hundred to 499 are considered to help you have very less than perfect credit. A score from five hundred to help you 600 is worst, 601 so you’re able to 660 is known as fair, and you will 661 to help you 780 is recognized as a great. A get out of 781 and payday loans Fairview you can better is great. Regardless of if a growing number of creditors are employing this program, that isn’t nearly because prominent given that FICO.

Because your credit score have an enormous affect of several out of life’s significant conclusion, you will not want it in order to include errors otherwise bad surprises. If you do select mistakes, you may want to right them with the credit bureaus. In case the report includes analysis you to reflects you badly, you then should be aware of the issues which means you could possibly get define them to prospective loan providers unlike getting trapped out-of shield.

Other functions examine your credit report-essentially along with your consent-and therefore in the event that you, without a doubt. By-law, you are permitted comment everything on your own credit history a year, and you will doing so does not affect your credit rating. Each one of the three U.S. credit reporting agencies-Equifax, Experian, and you can TransUnion-allows consumers one to free credit report per year, via AnnualCreditReport.

Ideas to Raise otherwise Keep Credit rating

If for example the credit rating is great, then you certainly must improve or take care of it. If you have less than perfect credit now, up coming be assured that one may boost they-you don’t need to call home which have a certain credit history throughout your daily life.

Credit agencies allow suggestions to fall from your credit score as time passes. Generally speaking, bad pointers drops off after 7 ages, however, bankruptcies stick to your own report having 10 years. Below are particular strategies that you might try improve otherwise keep credit history: