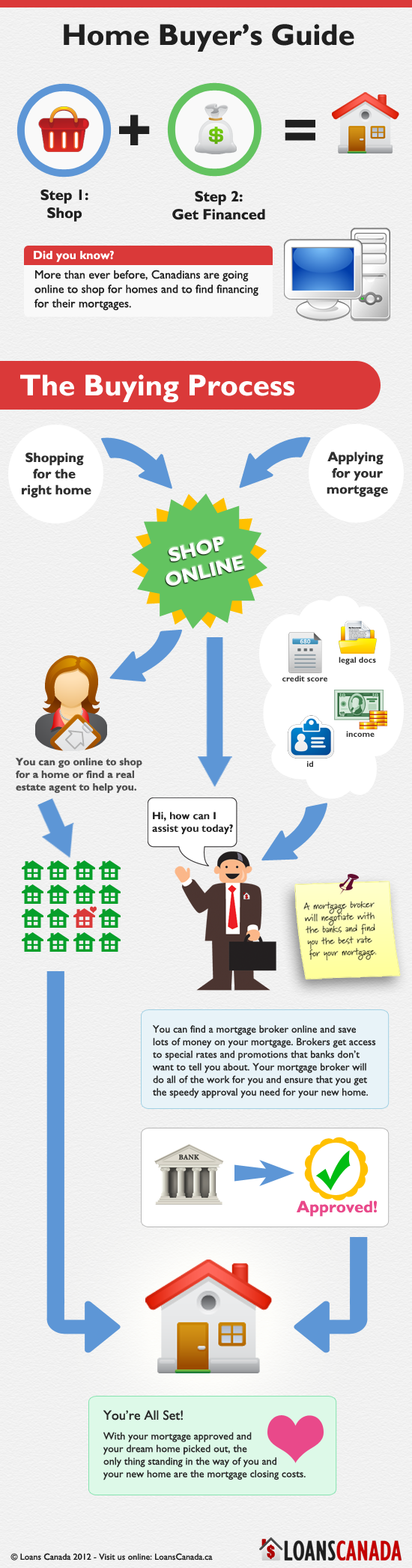

Homeowners commonly thought whether or not they can be discontinue their FHA home loan insurance policies superior. Cancellation is actually feasible significantly less than particular problems that count towards the if loan are initiated and exactly how large the original down-payment was.

For individuals who grabbed your mortgage out-of , you might dump Mortgage Cost (MIP) as soon as your loan-to-well worth proportion dips less than 78%. In the event you secured that loan blog post-, MIP reduction can be acquired shortly after an eleven-12 months period, but on condition that the advance payment was about ten%.

To have funds pulled through to the seasons 2000, there is no possibility canceling MIP. Its required to make certain that home loan repayments are produced punctually and also to hold the loan in a great condition so you’re able to be eligible for cancellation.

Cutting or entirely deleting FHA financial advanced may cause famous decreases in your payment per month. If you have built up at least 20% security of your home, one productive experience refinancing off an enthusiastic FHA loan so you’re able to good conventional loan. Rather, choosing a high deposit when buying the house or property could possibly get disappear MIP installment loans for bad credit in Phoenix expenses.

Even if getting rid of MIP totally may not be you can, will still be feasible to reduce their economic load. Trying to advice off experts in home otherwise mortgage lending have a tendency to offer actions that are specifically made to fit well within the brand new confines of your novel financial activities.

Refinancing so you can a traditional Financing

Altering out of a keen FHA mortgage in order to a conventional home loan often is completed to dispense on costs of fha mortgage advanced. Which flow often leads not only to the newest cessation out-of MIP costs but might also ounts and you may safer far more good interest rates.

It’s important to understand that refinancing pertains to particular closing costs. It seems sensible to assess in case your deals gathered by detatching MIP justify these types of initial expenses. To own effective refinancing, rewarding financial standards-together with having a top credit score and maintaining a minimal financial obligation-to-income proportion-is very important.

To make a more impressive Downpayment

For folks who enhance your down-payment to help you about 10%, you’re in a position to disappear the expense from the FHA mortgage top. This leads to less rates for your annual MIP and you will enables you to stop MIP costs shortly after just 11 ages.

Of the following this process, not only will it lessen your month-to-month outgoings in addition to facilitate that point until you is also terminate the mortgage insurance premium (MIP), hence protecting economic masters more a long period.

Possibilities so you’re able to FHA Funds

Will be FHA finance not be right for your circumstances, you might mention additional options for example Va and you may USDA financing. Va fund cater particularly into means out of pros, effective armed forces people, and their enduring partners by offering the benefit of zero off payment and you will getting rid of the need for month-to-month mortgage insurance policies. Qualified anybody is loans up to 100% of their amount borrowed with possibly advantageous criteria.

With the another type of top, USDA financing is actually sponsored of the Us Department out-of Agriculture’s Outlying Homes Services and provide professionals exactly like Va fund inside the which they none of them a down payment. This type of finance usually have alot more aggressive rates whenever in contrast to antique mortgage loans and therefore are best for people aiming on homeownership for the rural settings.

Bottom line

Facts FHA home loan top is important for the prospective homebuyer offered an FHA financing. On the different types of superior in addition to their will set you back to help you tips to possess reducing or deleting such premium, becoming informed could save you currency and you can stress about a lot of time focus on.

Consider your choices cautiously, whether it is refinancing to help you a conventional loan, and make more substantial deposit, otherwise investigating alternative financing programs such as for instance Virtual assistant and you can USDA loans. Towards correct strategy, you are able to homeownership less expensive and you may green.