Various kinds security are used for a protected private mortgage. Your options start around cash in a checking account, a car or a property. There are two main kind of loans you could get of banking companies or any other creditors: secured personal loans and you can signature loans. Guarantee is the promise from one thing of value as protection for the borrowed funds in case there are default for the percentage. Any time you standard towards a secured mortgage, the lending company could possibly get seize new advantage you bound just like the shelter. It escalates the exposure to you personally while the a debtor while you are decreasing the chance with the lender. Due to this, secured personal loans are generally less expensive and much easier discover recognition to have.

Don’t assume all financial requires equity, indeed, most dont. You can get a quick, versatile advance loan with www.paydayloancolorado.net/dillon/ RCS in place of placing any property at risk.

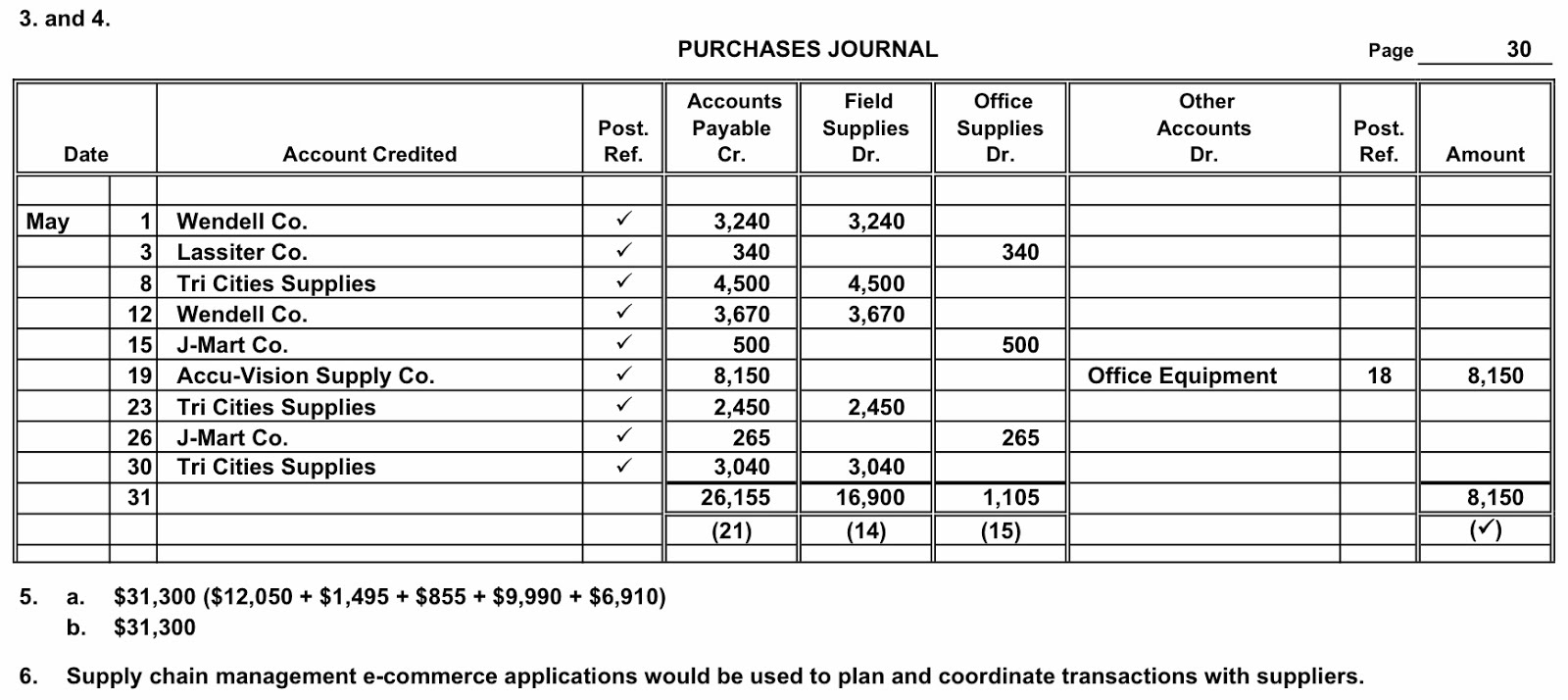

Mortgage brokers

Also known as mortgages, mortgage brokers are among the typical brand of secured finance. The real property youre investment functions as equity. Whenever that loan is in default on account of overlooked payments, the financial institution get foreclose into borrower’s family market it to recuperate people monetary losses.

Auto loan

By using away financing to cover the acquisition of a vehicle, truck, watercraft, cycle, or even a private squirt, the automobile is used due to the fact security on mortgage. Just like a home loan, the automobile is repossessed if the mortgage isnt reduced. Just as in a mortgage this is very negative toward bank, while the appeal on income of house is oftentimes towards the price, in lieu of reaching the best price.

What counts Just like the Equity?

Guarantee having secured loans will likely be everything of value, according to the kind of. How fast it can be became income are a vital idea. Loan providers whom specialize in business money utilise shares, device trusts, life insurance coverage, profit money-industry loans, and discounts levels to attenuate the risk. Lenders, whom specialise in the advantage-depending lending, enjoys an optimistic have a look at to your fine art, gold and silver coins, certain precious jewelry, as well as luxury bags. Particularly in reduced authoritative monetary solutions, an item can be utilized while the guarantee as long as they provides a steady market value.

Positives and negatives

- Your odds of getting accepted are large. Securing a loan having equity could possibly get aid in cutting your chance since the a debtor while having problems acquiring a loan, maybe due to borrowing issues or a quick credit history.

- You are qualified to receive a larger financing. During the the same vein, of the starting equity, you might be in a position to obtain extra cash than simply you’d otherwise have the ability to when you are lowering the lender’s exposure.

- It provides exchangeability on close-label. A guarantee oriented loan makes it possible to accessibility currency in the event that every of the fund are held for the assets that will be hard to offer, for example a house or belongings.

- For many who standard toward an equity loan, their premier risk is you will lose the fresh new house. Which is for example towards when you use an extremely beneficial item, like your home, so you’re able to contain the loan.

- They phone calls on you to currently has a top really worth advantage. You can borrow cash with a personal loan instead of risking anything and your credit score. It could be difficult to come up with the security called for to reach a loan if you’re not eligible for an enthusiastic unsecured loan.

Collateral money bring specific chance because if you standard with the repayments, you might dump brand new advantage one to served since the safety into the loan. Yet, if your finances are located in buy, a guarantee loan are going to be worth your while. By the permitting quicker rates and you will costs, protecting that loan that have collateral helps you to harmony specific exposure. Ultimately, you can even rescue tons of money by-doing you to.

In a nutshell, a multitude of possessions may be used given that guarantee to have a personal bank loan therefore the bank is talk to your on size, not just just what possessions you possess which will qualify your for a loan as a result of them, plus what you’re safe setting up since the equity.