Our home Home loan Disclosure Operate (HMDA) is actually enacted during the 1975 and needs creditors to collect and you can declaration research pertaining to particular programs/financing covered of the a dwelling. Controls C (12 CFR 1003) executes your house Mortgage Revelation Act. The goal of this type of requirements will be to tell you whether loan providers is conference the new homes need of their groups and you may/or if perhaps he or she is engaging in discriminatory financing strategies. A financial institution’s HMDA data is among the priiners so you can determine conformity which have Reasonable Financing regulations. An economic institution’s HMDA info is along with available to individuals every year.

You can find over fifty+ investigation industries a lender have to assemble/statement for each relevant app/mortgage. The amount of investigation things may differ; yet not, based a monetary institution’s financing regularity. The info as built-up/said covers numerous one another candidate/debtor investigation, loan study, and you will property analysis. Like, financial institutions must assemble the latest battle, sex, and you will ethnicity away from a candidate/debtor, possessions place, earnings, credit history, full items and you can costs, lien updates, an such like., to mention a few. Since the means of event and you can reporting these details may sound fairly quick, the procedure is a bit monotonous and you may will leave very little area for error. When the a lending institution exceeds online payday loan Oklahoma the latest mistake thresholds, examiners can require investigation are fixed and resubmitted and you can/or enforce municipal money penalties. It is essential you to definitely financial institutions purchase sufficient resources (knowledge, teams, expertise, etcetera.) to be certain conformity with the conditions.

HMDA Today

As stated a lot more than, our home Mortgage Disclosure Operate (HMDA) is introduced into the 1975 possesses been through of several transform along side ages. The very best changes; but not, occurred in 2015 with a change that has been required by the Dodd-Honest Act. The changes specified on the Final Laws was followed inside the amount. The first stage went to your affect , and you may worked generally that have determining and this finance companies was indeed and you can weren’t at the mercy of HMDA revealing. The following phase ran with the affect , and included the majority of the alterations. There were transform on the types of reportable transactions, the info necessary to feel amassed/advertised is actually considerably increased and also the process having revealing this info to help you supervisory businesses was also altered. Towards the , the economical Growth, Regulating Relief and you can Customer Protection Operate (EGRRCPA) try introduced. This used additional transform with the investigation collection/reporting need for particular establishments considering financing volume. Specifically, small filers, even as we need to call them, are exempt off gathering/revealing studies for over half of the knowledge fields.

These new HMDA rules may not be set in brick and we’ll consistently look for alter. Also the formal EGRRCPA tweaks, there are many different casual tweaks one to happen because of the varying perceptions of one’s standards if or not people come from the brand new CFPB, examiners, and/if not your own application/program providers. Although this is rather normal whenever a constraint experiences a major change, it reiterates the need for you to remain in the fresh discover. You won’t want to miss a reports otherwise change and you may stop up with HMDA violations.

HMDA Studies Resources

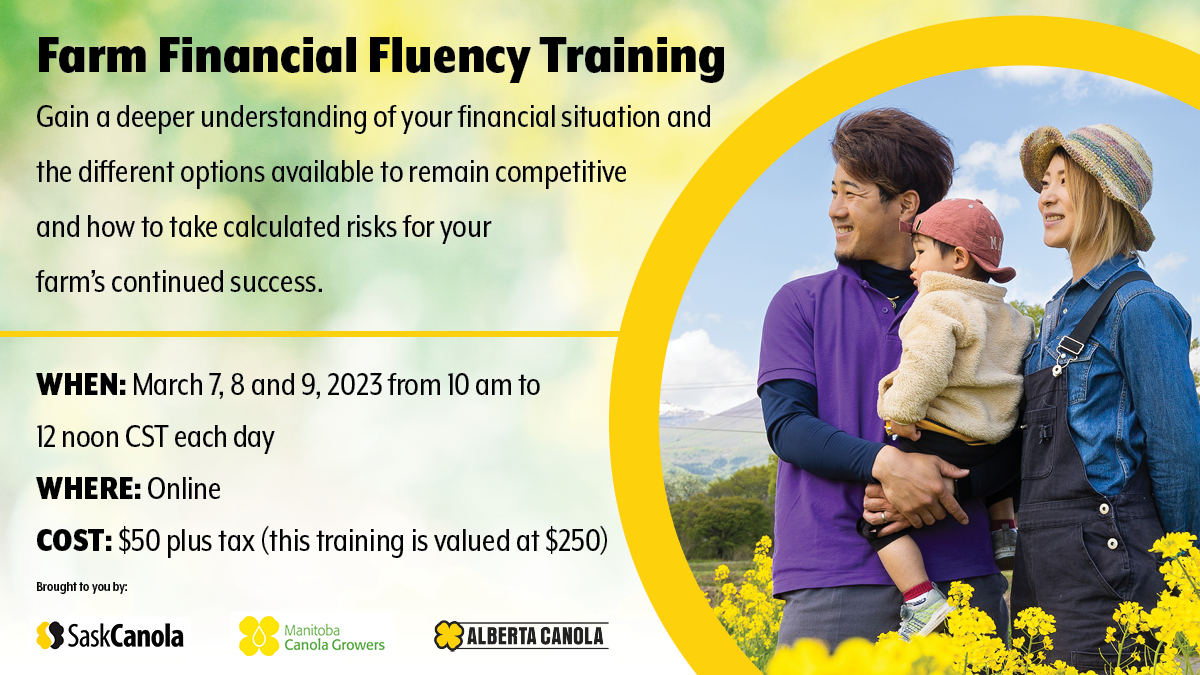

Our company is in the industry out of training bankers and you will quality knowledge are all of our top priority. All of our objective should be to view you and your lender create! It is certain you to definitely what we create, from inside-individual degree and you may webinars to the magazine and writings, is carried out within our trademark, plain English layout.

There is absolutely no that-size-fits-every approach to a monetary institution’s education means. That being said we would highly recommend certain diversity regarding methods you choose. Range can not only help your budget but may also provide your different views. Perchance you attend an in-individual appointment all number of years and fill in one holes which have webinars. Maybe you realize our weblog to keep track of significant regulatory advancements and you may consider our very own magazine for much more within the-depth study. The point is, you could potentially customize education for the wishes and requirements.