The guy plus failed to know the way difficult it could be to store up the regards to the fresh offer, since the guy didn’t read how much cash really works our house do you need. There is absolutely no specifications you to definitely a home inspector look at the house in advance of an agreement-for-deed arrangement is actually signed. When Harbour advised your he had a need to get insurance coverage, he says, the insurance team already been giving your problems with the house one to the guy didn’t even understand resided-you to file he exhibited me, including, advised your that http://www.availableloan.net/payday-loans-md their rake board, that is a piece of timber close their eaves, try proving deterioration.

And you can 2nd, Satter said, most of these companies are aggressively focusing on communities in which people strive which have borrowing from the bank because of early in the day predatory credit techniques, like those one to fueled the new subprime-home loan crisis

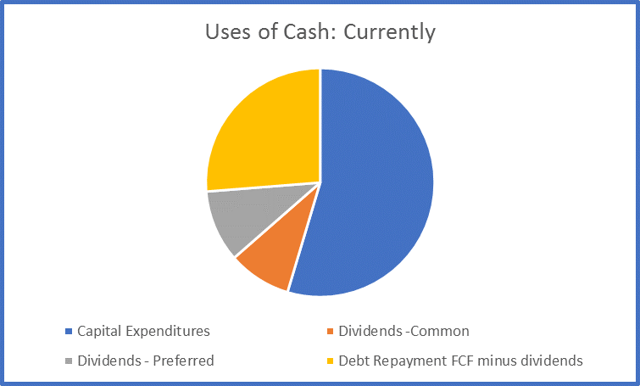

So it map, included in the Judge Support issue, shows brand new racial composition of the areas in which Harbour services are situated in you to Atlanta state. (Atlanta Judge Aid Society)

Nothing is inherently completely wrong with contract-for-deed agreements, states Satter, whoever dad, Mark Satter, assisted plan out Chi town citizens against the routine about 1950s. Will still be simple for providers who are not banking companies to invest in attributes from inside the a reasonable way, she said. A san francisco begin-right up named Divvy, for example, are assessment a rent-to-individual design for the Kansas and you will Georgia that delivers manage-feel people some equity in the home, regardless of if they default towards costs. However, there are two main explanations this type of contract-for-deed preparations see instance unjust, Satter told you. Very first, the fresh new land a large number of these firms purchase are located in terrible condition-of several got bare for decades in advance of being ordered, as opposed to this new homes ended up selling to own price for action on the 1950s, which often got left behind of the white residents fleeing so you can new suburbs. Fixer-uppers create even more difficult to own do-feel customers to meet up with all regards to the deals, since home need really really works.

Brand new credit uck, making it possible for banks supply subprime finance and other lending products in order to people that or even may not have entry to home loans

In a number of implies, the fresh concentration of price-for-action characteristics when you look at the Ebony neighborhoods is actually a medical outgrowth regarding how it happened inside homes boom and bust. Often, these things energized exorbitantly highest interest levels and you can targeted African Us americans. One study discovered that between 2004 and you can 2007, African Americans had been 105 per cent more likely than white consumers so you can provides high-cost mortgage loans getting house commands, although controlling having credit score or other chance things. Whenever each one of these someone forgotten their houses, the banks got them more than. Those who failed to offer at the auction-usually those who work in predominantly Ebony neighborhoods where individuals with money did not need certainly to go-wound up in the profile of Federal national mortgage association, which in fact had insured the borrowed funds financing. (Speaking of so-named REO, otherwise real-home possessed house, as the lender had them immediately following failing woefully to offer them from the a property foreclosure public auction.) Fannie mae up coming considering these house up at affordable prices so you can investors which wished to have them, including Harbour.

However, Court Services alleges you to definitely Harbour’s visibility during the Atlanta’s Ebony communities is more than coincidence. Of the choosing to simply get house of Federal national mortgage association, the brand new suit says, Harbour ended up with residential property in the areas one experienced the most significant level of foreclosures, which are the same teams targeted by the subprime-mortgage brokers-teams regarding color. Perhaps the Fannie mae house Harbour purchased had been when you look at the extremely African American communities, brand new suit alleges. The common racial constitution of the census tracts within the Fulton and you can DeKalb counties, where Harbour ordered, was more than 86 percent African american. Almost every other buyers in identical areas you to definitely bought Fannie mae REO functions available in census tracts which were 71 per cent Dark colored, the fresh new suit states. Harbour and additionally targeted the products it makes at the African People in america, the suit contends. It don’t market the contract-for-deed plans from inside the press, toward broadcast, otherwise on tv within the Atlanta, the fresh suit claims. Instead, Harbour build signs within the African american communities and offered referral incentives, a practice and this, the latest lawsuit alleges, created that it was generally African Us americans which observed Harbour’s promote.