Coaches just who bought with the CalSTRS Teacher Financial may now utilize the brand new CalHERO Professor Financing system so you can refinance and you may combine their in the near future as bursting CalSTRS mortgage and prevent a train destroy waiting to takes place.

This new CalSTRS home buying system try left behind when you look at the , as stated contained in this announcement, as they are unable to bring more appealing resource getting truth be told there members(including CalPATH).

It’s time to Refinance The CalSTRS Mortgage

The CalSTRS real estate system try unknowingly install to falter right from the start given that CalSTRS simply accredited buyers dependent 80% of your own price, up coming offered CalSTRS members a great deferred desire (zero costs) second financial getting 17% of one’s conversion process rates and you can didn’t take into account the future amortized payment whenever choosing their capability to repay down the road.

CalSTRS are generally qualifying individuals getting funds they could perhaps not pay for to your hopes individuals you will re-finance later.

Is the CalSTRS Deferred Attract next Mtg. Just like a poisonous Case Financial?

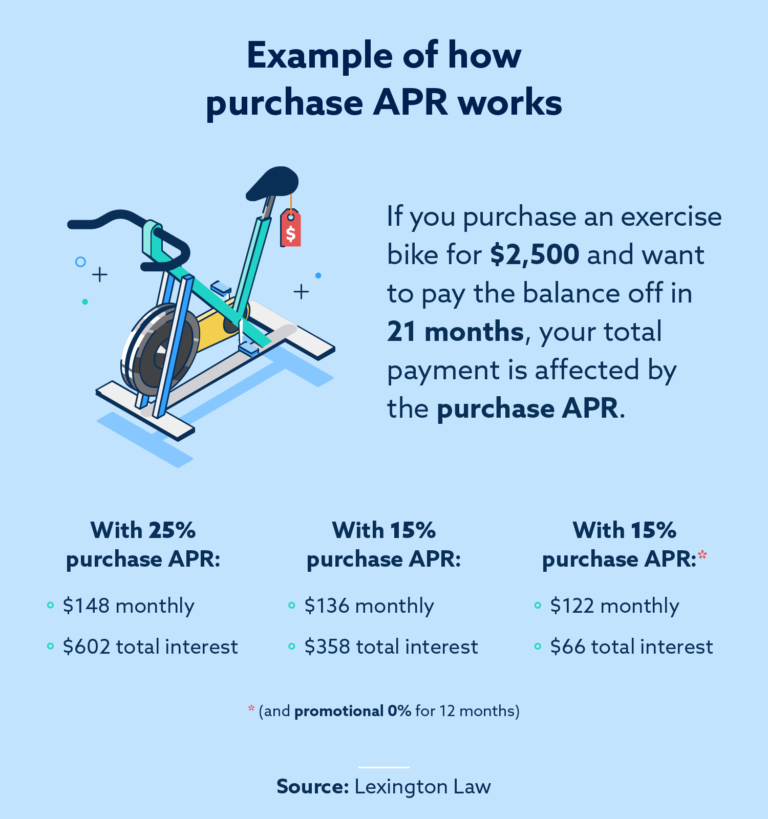

New CalSTRS deferred notice second financial expands through the years, same as a poisonous adversely amortizing changeable price home loan ouch. The rate where they develops is the identical interest rate of one’s first mortgage. Day-after-day you to definitely second mortgage is deferred they will continue to get big.

One other reason the CalSTRS 2nd mortgage payment might be much higher is basically because the 2nd mortgage payment identity try amortized more than twenty five many years…..maybe not three decades.

Like: Individuals who sold in could see expands of $250 to $600+ inside their total mortgage repayment whenever they do not combine the second mortgage into the the new CalHERO Teacher Financing program now.

A far more in depth data of your own exposure and value troubles relevant to your CalSTRS (and CalPERS) home loan apps will likely be see here.

Your CalSTRS second Home loan are Bursting!

In the event the price try $325,000, the 17% next mortgage harmony are $255 payday loans online same day Oregon originally $55,250. If the interest rate was 5.75% at that time, their next financial tend to delayed from the $step three,177 of simple focus every year. Five years afterwards, your current equilibrium tends to be doing $71,135!!

You to definitely $71,135 have a tendency to today become amortized more than twenty five years and increase your payment from the $445/day…..which is a train destroy would love to occurs otherwise refinance.

Earlier Hurdles so you can Refinancing good CalSTRS Loan

- Security CalSTRS borrowers haven’t had adequate security so you can consolidate the 80% first-mortgage in addition to their 17% deferred notice (today larger) financial on the that low rate financing up to now.

- The servicer of your own CalSTRS mortgage could have been hard or usually minutes unwilling to subordinate the second home loan and enable consumers in order to refinance the initial home loan. When they performed concur, they would promote CalSTRS players an interest rate that was much higher than just what it will be, hence reducing the advantage of refinancing.

Of many CalSTRS borrowers skipped on being able to re-finance whenever prices had been within its reduced because of these two big roadblocks.

Try CalHERO the most suitable choice to Refinance a beneficial CalSTRS Financing?

I do believe it’s very apparent that emptying the deals otherwise later years account to pay off otherwise reduce the second financial try maybe not a wise monetary flow, however may want to speak to your CPA or Financial Adviser. And, who’s that sort of cash seated inside their savings account?

Having fun with an FHA financing so you can re-finance a great CalSTRS blend financing probably won’t save you as frequently money as a result of the FHA mortgage insurance costs.

The brand new Amounts Cannot Lie

To find out if youre eligible and you will/otherwise how much cash you can save of the refinancing their CalSTRS first & 2nd mortgage toward you to definitely financing and steer clear of a train ruin, check out the brand new CalHERO professor financing and contact me personally or label (951) 215-6119.